September 22, 2011 | permalink

(Originally published at FastCompany.com on September 22, 2011.)

Why have global food prices spiked not once, but twice in the last three years, raising the specter of famine and triggering worldwide food riots—including the Arab Spring? Many explanations have been floated, including climate change-related droughts in Australia, volatile oil prices, “food security” export restrictions, and last but not least, feeding China’s strategic pork reserve.

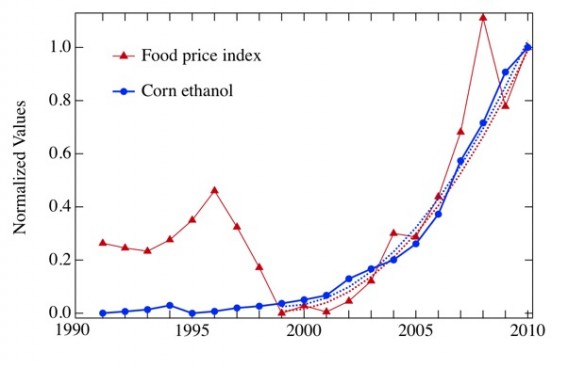

But according to a scientific paper released this morning by the New England Complex Systems Institute, there are only two factors that matter: ethanol and financial speculation. The former is easier to prove. A drop in the bucket only a decade ago, ethanol will consume a remarkable 40 percent of the U.S. corn crop this year, comprising 16% of world corn production and 4% percent of total grain production overall. The paper’s authors mapped the rise of ethanol production to the steady climb of the United Nations Food and Agriculture Organization’s Food Price Index since 2004 and found a close fit, much closer than Australia’s droughts (too small), oil price spikes (too late), or China’s craving for pork bellies (big, but not big enough). “Ethanol is much bigger. It’s bigger by a factory of 20,” says Yaneer Bar-Yam, one of the paper’s authors and the president of NECSI.

The paper’s second claim is more controversial. While ethanol is responsible for the long-term increase in baseline prices, it can’t explain the bubble-and-bust dynamics of 2007/2008 and 2010/2011. So NECSI’s researchers set out to build an all-purpose mathematical model of speculative bubbles, feeding it price data to see if there was another close fit.

What they found refutes the OECD’s findings and confirms the suspicions of Harpers’ Frederick Kaufman—the repeal of the Commodity Exchange Act of 1936 and the deregulation of commodity futures in 2000 transformed the futures markets from an instrument of liquidity to a place to park one’s money. Instead of being a place where farmers and agricultural businesses set reasonable prices, the markets have become just another place for speculation.

“That regulation had limited the ability of investors to invest beyond a certain amount,” says Bar-Yam. “Its repeal enabled the index funds, which in turn opened the door to people who were not in the agricultural investment business to go into the commodities markets of corn, wheat, and so on.”

All of that money—commodity index holdings soared from $13 billion in 2003 to $317 billion in 2008—inevitably caused distortions in the market. “If you look at our figures, you’ll see there’s a huge difference between the futures price or the spot price and what should be the equilibrium one,” Bar-Yam says.

The authors’ recommendations are straightforward and immediate—to drive down prices for the world’s poor, governments must restore financial regulations (including the Commodity Exchange Act) and begin winding down ethanol production. “There is a moral imperative here,” says Bar-Yam. “And from an economic standpoint, efficient allocation and optimality are desirable things,” neither of which are currently being served. And if they don’t, as the authors noted last month in a related paper, the turmoil of Arab Spring may go global.

» Folllow me on Twitter.

» Email me.

» See upcoming events.

Greg Lindsay is a generalist, urbanist, futurist, and speaker. He is a non-resident senior fellow of the Arizona State University Threatcasting Lab, a non-resident senior fellow of MIT’s Future Urban Collectives Lab, and a non-resident senior fellow of the Atlantic Council’s Scowcroft Strategy Initiative. He was the founding chief communications officer of Climate Alpha and remains a senior advisor. Previously, he was an urban tech fellow at Cornell Tech’s Jacobs Institute, where he explored the implications of AI and augmented reality at urban scale.

January 31, 2024

Unfrozen: Domo Arigatou, “Mike 2.0”

January 22, 2024

The Future of Generative AI in Architecture, Engineering, and Construction

January 18, 2024

The Promise and Perils of the Augmented City

January 13, 2024

Henley & Partners: Generative AI, Human Labor, and Mobility

----- | January 22, 2024

The Future of Generative AI in Architecture, Engineering, and Construction

----- | January 1, 2024

----- | August 3, 2023

CityLab | June 12, 2023

Augmented Reality Is Coming for Cities

CityLab | April 25, 2023

The Line Is Blurring Between Remote Workers and Tourists

CityLab | December 7, 2021

The Dark Side of 15-Minute Grocery Delivery

Fast Company | June 2021

Why the Great Lakes need to be the center of our climate strategy

Fast Company | March 2020

How to design a smart city that’s built on empowerment–not corporate surveillance

URBAN-X | December 2019

CityLab | December 10, 2018

The State of Play: Connected Mobility in San Francisco, Boston, and Detroit

Harvard Business Review | September 24, 2018

Why Companies Are Creating Their Own Coworking Spaces

CityLab | July 2018

The State of Play: Connected Mobility + U.S. Cities

Medium | May 1, 2017

Fast Company | January 19, 2017

The Collaboration Software That’s Rejuvenating The Young Global Leaders Of Davos

The Guardian | January 13, 2017

What If Uber Kills Public Transport Instead of Cars

Backchannel | January 4, 2017

The Office of the Future Is… an Office

New Cities Foundation | October 2016

Now Arriving: A Connected Mobility Roadmap for Public Transport

Inc. | October 2016

Why Every Business Should Start in a Co-Working Space

Popular Mechanics | May 11, 2016

Can the World’s Worst Traffic Problem Be Solved?

The New Republic | January/February 2016